Finance isn’t just about managing money—it’s about controlling your future. Whether you’re earning your first paycheck, starting a business, or planning for retirement, understanding the basics of finance gives you the freedom to make choices that work for your life.

In a world where inflation, debt, and unpredictable expenses are part of everyday life, good financial habits can be your strongest defense—and your smartest investment.

What Is Finance? A Simple Definition

At its core, finance is the art of managing money. It involves earning, spending, saving, borrowing, and investing—all while making decisions that improve your financial well-being over time.

There are three key areas of finance:

- Personal Finance – Managing individual or household money.

- Corporate Finance – Handling business capital, profits, and expenses.

- Public Finance – Government-level financial management (like taxes and budgets).

This article focuses on personal finance—because that’s where financial freedom truly begins.

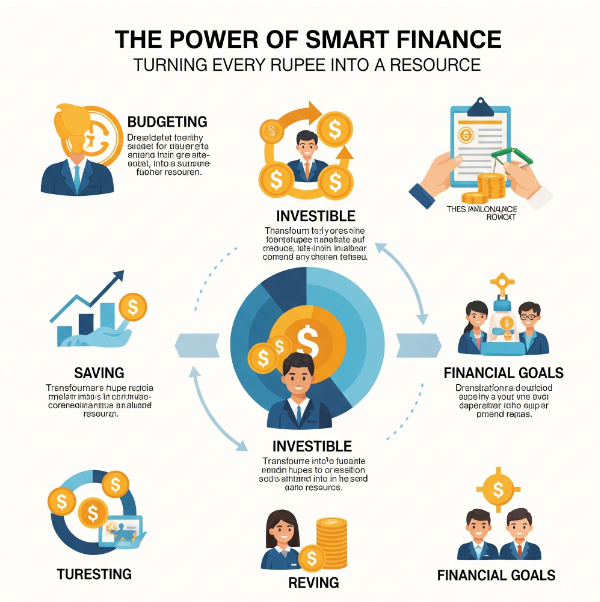

The Pillars of Personal Finance

A strong financial foundation rests on five core principles. Mastering these is the key to financial stability and future growth.

1. Budgeting

A budget is simply a plan for your money. It helps you control your spending and ensures that your income is working toward your priorities.

- Track your income and expenses

- Categorize spending (needs vs wants)

- Set monthly limits and review them often

2. Saving

Saving is not just putting money aside—it’s protecting your future self. Whether for emergencies, travel, or a big purchase, saving builds peace of mind.

- Aim to save at least 20% of your monthly income

- Start with an emergency fund covering 3–6 months of expenses

- Use savings accounts or fixed deposits for low-risk accumulation

3. Investing

Once you’re saving consistently, invest to grow your wealth. Investments beat inflation and build long-term assets.

- Start with mutual funds or SIPs (Systematic Investment Plans)

- Explore stocks, real estate, or gold as your financial knowledge grows

- Stay invested for the long term and avoid panic selling

4. Debt Management

Not all debt is bad—but unmanaged debt can ruin your finances. Learn how to handle loans and credit wisely.

- Pay credit card bills in full every month

- Avoid high-interest loans unless absolutely necessary

- Use EMI calculators to plan repayments before borrowing

5. Retirement Planning

Even if retirement feels far away, time is your biggest asset. Early planning ensures financial independence later in life.

- Invest in retirement plans like NPS, PPF, or pension funds

- Estimate your post-retirement needs and start saving accordingly

- Let compound interest work its magic over the years

Why Financial Literacy Is a Life Skill

Despite being critical, personal finance isn’t taught in most schools. That means millions of people enter adulthood without the tools to manage their income wisely.

Financial literacy empowers you to:

- Avoid debt traps

- Make informed investment decisions

- Build a secure future for yourself and your family

- Navigate financial crises without panic

You don’t need to be a financial expert—just being aware and proactive is enough to stay ahead.

Practical Finance Tips You Can Start Today

Here are simple, actionable steps to improve your financial health:

| Tip | Description |

|---|---|

| Track Expenses | Write down every rupee you spend for 30 days. Patterns will emerge. |

| Automate Savings | Set up an auto-transfer to a savings account right after payday. |

| Set Goals | Saving is easier when tied to specific goals (vacation, car, home). |

| Avoid Impulse Buys | Use the 24-hour rule before buying non-essential items. |

| Learn Constantly | Read finance blogs, watch videos, or follow experts on social media. |

The Role of Technology in Modern Finance

Thanks to digital banking and finance apps, managing money is now easier than ever.

Popular tools include:

- Budgeting apps like Walnut, Money Manager, and Goodbudget

- Investment platforms like Groww, Zerodha, and Paytm Money

- UPI wallets and banking apps for instant payments and bill tracking

The key is to use these tools not just for convenience, but to develop better financial habits.

Breaking the Myths Around Money

Here are some common finance myths—and the truth behind them:

- Myth: You need a high income to save.

Truth: Saving is a habit, not an amount. Start small and stay consistent. - Myth: All debt is bad.

Truth: Some debt, like home loans, can be an asset if managed wisely. - Myth: Investing is gambling.

Truth: Investing is based on research, long-term growth, and calculated risk.

Final Thoughts: Finance Is Freedom

Being in control of your finances doesn’t mean you have to be rich. It means you know where your money is going, you’re prepared for the future, and you’re not stressed every time an unexpected expense shows up.

Whether you’re saving for your first bike, your child’s education, or your own retirement, smart financial habits will take you further than luck or income ever could.

Start today. Track your expenses, make a budget, learn about investing, and protect your future. Your financial freedom is not just a dream—it’s a decision away.

Related Post

- Choosing the Right Loan: A Step-by-Step Guide to Smart Borrowing

- All You Need to Know About Loans: A Complete Guide to Smart Borrowing

- The Power of Smart Finance: Turning Every Rupee into a Resource

- Why Insurance Matters: A Silent Guardian in Everyday Life

- Mastering Insurance and Finance: A Practical Guide to Building a Stronger Financial Future

Leave a Reply